- home

- project

- Forschung

- research

- investigación

- исследование

- recherche

- BWL

- Betrieb

- Finanzen

- Noteninflation

- Schummelkultur

- Akademisierung

- Männerrechte

- Politik

4.2. sales market

Companies earn their living by selling a benefit to customers when selling prices are higher than unit cost. Customers buy the products if they value the benefits higher than the price. Companies

and customers therefore share the difference between benefits and unit costs. The division need not be the same or fair. However, a too one-sided distribution would mean that the difference is

too small for the customer and they prefer to buy other products for their limited income. Conversely, too little profit would mean that companies would no longer offer these services and that

customers would have to look for an alternative.

4.2.1. Marketing (0)

The marketing was formulated as point zero, because here the value creation has its starting point. In terms of color, this function is marked as an organizational task. Even the best benefit

must first be sold to the customer. Since companies have sufficient competence to be able to offer their customers sufficient benefits at reasonable costs, the company's added value is based on

communication with potential customers.

In a high-tech economy, companies mainly incur fixed costs that are not directly dependent on capacity utilization. With a larger workload, you can spread those costs to a larger amount, reducing

unit costs. Of course, the increase in capacity also causes higher fixed costs, so in a broad sense, there is also a connection. Nevertheless, it is advantageous to use the size-dependent cost

advantages, which is why always a minimum size must be achieved. For this purpose, the textbooks suggest a market-oriented corporate governance, which is described in the following table:

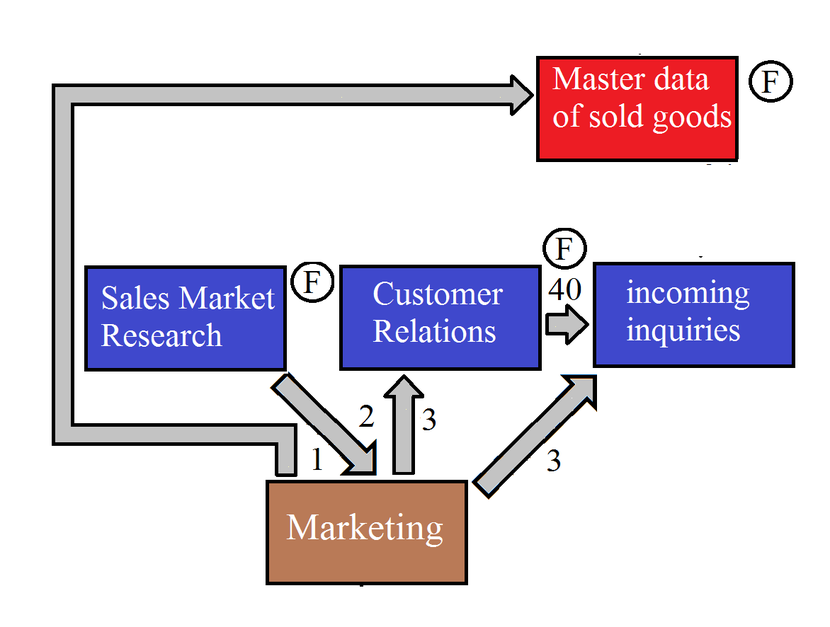

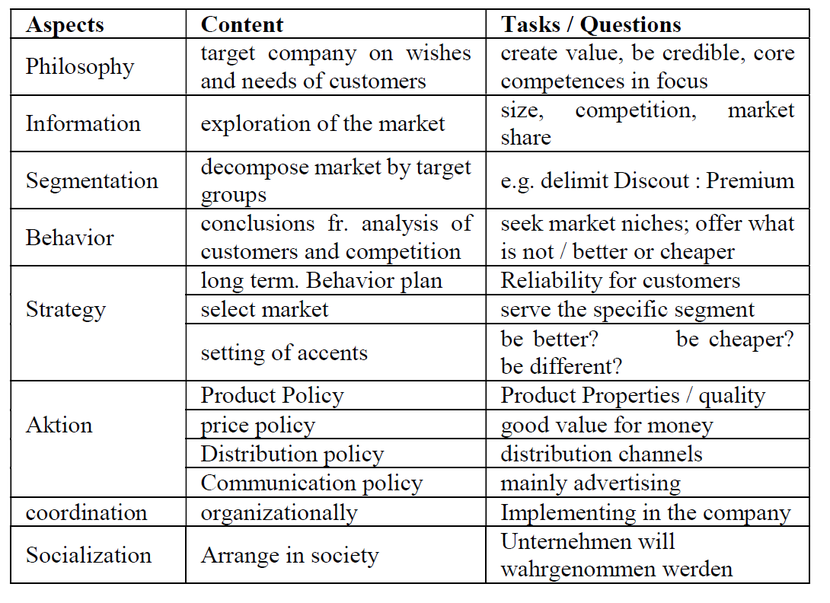

Fig. 25: Market-oriented corporate governance

(Source: in extension of: H. Meffert, B. Burmann, M. Kirchgeorg, fundamentals of market-oriented enterprise management, 9th ed., Wiesbaden 2000, P. 8, from the 10th edition transformed)

The marketing policy as content of the aspect "action" is of particular importance. Every business is defined by the benefits it offers its customers and the products that it designs. The core of

this orientation to the customer is the marketing policy. It is divided into

Product policy characteristics and quality,

Pricing policy high or low, in inverse relation to quality,

Distribution policy by which route the product comes to the customer,

Communication policy Advertising and other tools.

The product policy also has to decide which products should be offered. This also defines the concrete characteristics and above all the price requirement, which is administratively recorded in

the master data. (Arrow 1)

The marketing policy is based on the relevant sales market, which should be illuminated with a market research. (Arrow 2) The delineation can still be based on objective criteria in terms of

customer benefit, but also with a segmentation (aspect of market-oriented corporate governance according to Fig. 25 on page 98).

The aim of marketing is to attract customers, and especially regular customers who are satisfied with the performance and buy the products over again. But also the acquisition of new customers,

who should become as regular customers as possible, is important. They should be motivated to approach the company with their wishes in a concrete inquiry. (Arrow 3)

Advertising as part of communication policy plays a key role in attracting customers. It must not contradict the other procedures. The product features that are advertised must also be present.

That must be coordinated with the technology (function 5 - construction).

Especially the price and product policy as content of the aspect "action" must be supported with data. In addition to market research, this should primarily provide the cost and benefit

accounting from internal accounting. A success control of advertising would be useful; but she is difficult. Nevertheless, in order not to cause useless costs, a goal should be formulated for

each advertising measure. Subsequently, the search should be made for the data from which the achievement of the goal could be read. Thereafter, it should be noted to what extent these data have

changed.

4.2.2. Master data of sold goods (1)

Master data must be defined for the product program. As a unique identifier is an article no. forgive. These include a short description of the article, possibly a more descriptive long

description, size / weight, and in particular the required prices. Other features may be useful in individual cases. In addition to electronically stored data of the goods master data should

under the article no. also the technical documentation of the goods, the history of the development of the product, previous advertising activities and possibly reactions in the media are

archived. These are not master data in the narrow sense, but also no transaction data. This additional information can be digitized; because they are not needed in day-to-day business, nothing

speaks against analog archiving.

Under the item no. Sales and turnover figures should also be found and it should be noted how much profit was generated, even if the distinction to other products is often difficult. The article

master data should then be defined so that the necessary background for understanding the current transaction data can be called up at any time.

4.2.3. Sales Market Research (2)

Sales market research serves to understand the behavior of current and potential customers. This includes knowledge of the economic context. Nevertheless, the function is assigned to the sales

color.

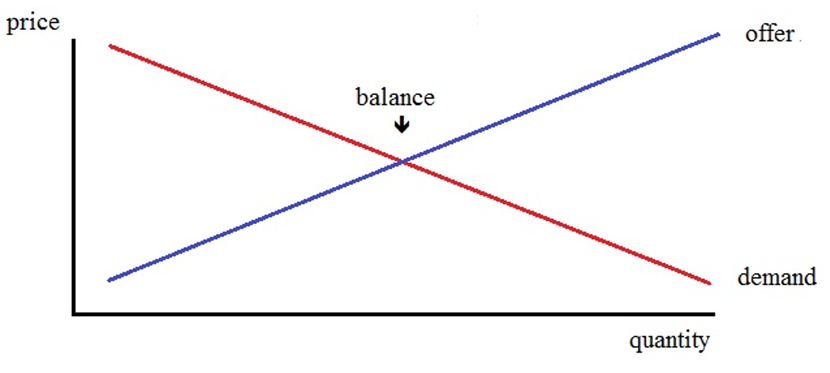

Recognizing that supply and demand dominate prices has been one of the key messages in economics since the book by Adam Smith in 1776, "An Inquiry into the Nature and Causes of the Wealth of

Nations." After that, supply and demand have been presented for generations with the following graphic:

Fig. 26: classic supply and demand function

(Source: https://mueller-consulting.jimdo.com/research/subjects/offer-demand/)

This model is based on many small suppliers and many small buyers. The increase in volume at higher prices is achieved by the fact that then more suppliers (according to the idea of Smith, for

example, small craftsmen) manufacture these goods. These assumptions are no longer in the ordinary range today. The mechanism still works a little bit, but mostly not as described by Adam

Smith.

Smith distinguished the market price, formed by supply and demand, from the natural price, which coincides with the average cost (wage, land rent and profit). The market value fluctuates around

the natural value, but in the long run can not move far away from it. Under the conditions of industrial production with few large suppliers, this means that with increased demand and larger

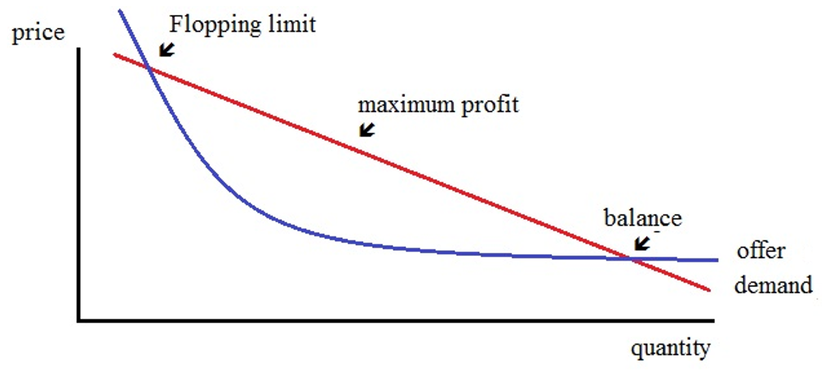

quantities produced, the unit costs decrease due to the effect of fixed cost degression, as shown in the following graph:

Fig. 27: cost function

(Source: https://mueller-consulting.jimdo.com/research/subjects/offer-demand/)

Now, if you assume like Adam Smith, that demand will increase linearly with falling prices and the natural price declines with costs, then the following supply and demand function will

occur:

Fig. 28: Supply-demand function in the oligopoly

(Source: https://mueller-consulting.jimdo.com/research/subjects/offer-demand/)

The function would not have one, but two intersections. In a demand below the first intersection point, referred to here as the flop limit, the cost of the provider is not covered. This product

would not be offered. The intersection of supply and demand comparable to classic graphics would be second. However, this would probably only be achieved under the conditions of a price war if

stronger suppliers with lower costs wanted to oust a competitor from the market. More often, however, they are likely to seek a profit maximum, where they would achieve even high profits and the

weaker competitors low profits. Under these conditions, the market price would therefore be well above the natural price. The market would only start to move if additional large foreign suppliers

wanted to penetrate the domestic market. However, under the conditions of a globalized world market, this possibility has already been taken into account. But then often not more supply and

demand regulate the price.

Sales market research involves gaining all information about potential customers and their needs, regardless of whether they are won on schedule or incidentally. Especially the unplanned

information should be recorded in a structured way.

4.2.4. Customer Relations (3)

Starting from the recognition that it is often costly to recruit a new customer, the customer once gained should be motivated to buy more frequently and thus turned into repeat customers.

Maintaining relationships with regular customers and potential key accounts is an important task in this context. This requires gathering information about this group of people, especially from

previous purchases. But every other customer loyalty is desired. Even if companies can bring much about their customers experience today, so there will still be no close relationship between them

and the seller, which goes beyond the granting of comps.

For an ERP system, the distinction must first be organized into customer groups. At least between regular customers (according to frequency of the purchases). Large customers (by sales volume)

and other customers. Threshold values can be formulated for this, e.g. Number of purchases or sales in the last 12 months. For the Customer Relations function, the goods and customer master data

can then be linked with previous sales, thus creating an automatic demand profile for important customers. (Arrow 38) It must be possible to do a comparison of sales and cost of goods delivered,

thus the gross profit from the business with such customers can be quickly retrieved. With such an automatic system, important customers can be reported to sellers automatically.

If special costs are incurred with regard to the importance of the customer, this should also be registered. This could also be the working hours of salespeople who care for the important

customers particularly intensively. This could be technically organized by introducing a fourth data field for the allocation of costs in addition to the account, cost center and cost unit. This

could also be used several times, e.g. for an inventory number, at application for machines for the customer number for special customer or project number for spontaneous reports when there are

no cost center is to be established. With this information, exaggerations can be prevented. The company wants to make a lot of money with important customers; Too intensive care and excessive

discounts may jeopardize this goal. The customer relations function must receive the necessary balance.

4.2.5. incoming inquiries (4)

Advertising has invited the masses of potential customers to find out more. In sales, it is important to convince these interested parties of their own products and win them over as customers. In

order to check advertising success, the number of inquiries received should be recorded in order to be able to identify temporal relationships with advertising in the longer term. From a concrete

inquiry also not expressly mentioned interests and needs of the prospective customers should be recognized. These can be recorded in customer master data.

Requests received from potential customers should be stored and evaluated, even if they did not come to an order. You can tell from them what articles they need and you can try to get orders from

them in the future. With the goods master data, the wishes of the (potential) customer in particular with the assignment of an article no. translated into the language of your own company. Next

is searched for a previous relationship and a customer no. assigned or a new customer master created. (Arrow 39) For this, a license plate as a prospective customer in contrast to customers

already supplied would make sense. If there are no orders after a long time, this customer no. also be deleted again. The customers that meet these criteria could be reported by the

software.